Investing is now closed

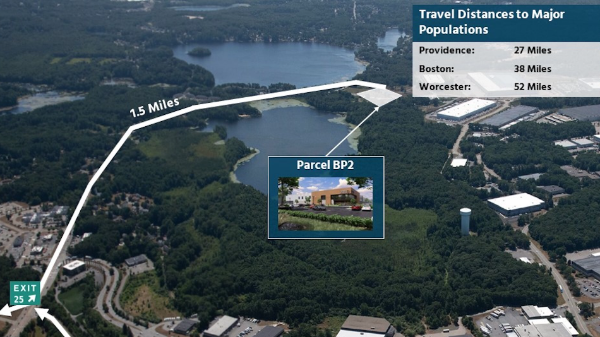

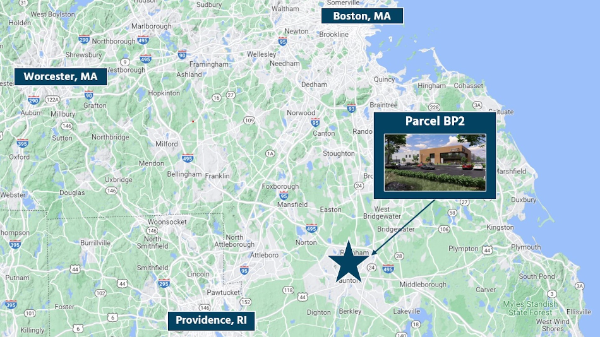

Myles Standish Industrial Development

Industrial |

Taunton, MA

Don't miss your next opportunity to invest. Sign up to view all current deals on our Marketplace.

Already have an account? Sign in to view details

Flex industrial development addressing demand by bringing high power capabilities, a key market differentiator, to Massachussets' largest industrial park in a 97%+-occupied submarket.

Deal Highlights

- Rare, high power capability to help satisfy increased demand

- Robust market fundamentals: sub-5% vacancy, ~10% YoY rent growth

- One of the final developable sites in Massachusetts’ largest industrial park

Browse Other Investment Opportunities

Compare and review commercial real estate projects from coast to coast to build your investment portfolio. Every deal kicks-off with a live webinar where you get your questions answered directly by the project sponsors.

Invest Now

Andover, MA

Discounted Boston MSA Flex/R&D - 23 Frontage Road

Acquisition of a 100% leased two-story flex/R&D building in Andover, MA, purchased at a discount to replacement cost and prior sale, with a mark-to-market strategy upon lease rollover in 2027.

Flex R&D

Opportunistic

Invest Now

Andover, MA

Discounted Boston MSA Flex/R&D - 23 Frontage Road

Acquisition of a 100% leased two-story flex/R&D building in Andover, MA, purchased at a discount to replacement cost and prior sale, with a mark-to-market strategy upon lease rollover in 2027.

Flex R&D Opportunistic

Build something real with the nation's largest online private equity real estate investing platform: Crowdstreet.

Create your account for free to browse all available deals and begin building your real estate portfolio.